Facebook & Apple are changing the face of mobile payments

Two interesting new developments in the area of mobile payments have recently caught our attention. Could they be a hint of what’s to come? With the news that 23% of ecommerce in the UK now takes place on mobile, mpayments look like they could be the next big driver of online retail growth.

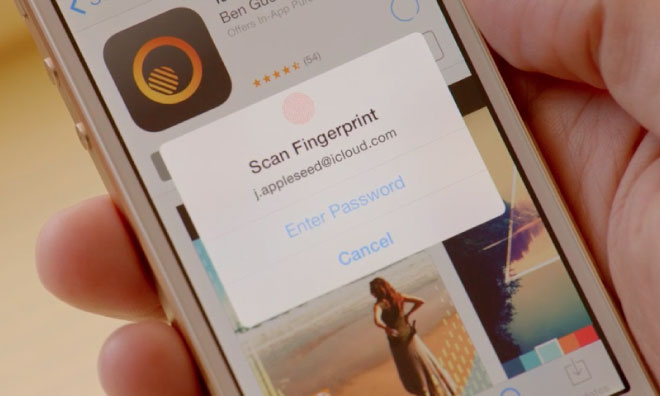

1. Apple fingerprint payments

Amongst all the hype around the new Apple iPhone launch, much of the attention has been focused on the new Touch ID technology. It lets you unlock your screen with just the touch of a finger (or paw).

But what’s really exciting is that not only can a fingerprint unlock your phone, it can also be used for your iTunes account. And even better, Apple have announced their intention to roll the capability for payments out to app developers, and maybe even to the mobile web.

There’s been some speculation that this could be Apple’s answer to Amazon’s ‘1-click’ technology. It does away with the need to constantly enter your password when using your phone. And it’s a short step from there to getting rid of the need to enter your credit card number when buying on mobile.

Obviously security comes first for many consumers when thinking about mcommerce. The new fingerprint payments could make buying from your mobile device a lot safer, with no need to save your credit card details within an app.

The German group that managed to hack the technology have got a lot of headlines, but their attempt required James Bond levels of ingenuity. After all, most people are comfortable using NFC-enabled Visa cards to buy coffee. There’s a much bigger chance of those being stolen than of someone recreating your fingerprint using complicated methods.

2. Facebook payments

The other interesting mpayment news is from Facebook. They’ve partnered with the mobile payments company Braintree (recently bought by PayPal) to test a way for consumers to pay on their phones using ‘Auto-fill with Facebook’. And they’re trialling the service with two apps – Jack Threads, a men’s fashion retailer, and Mosaic, who sell photobooks.

It works for customers who have previously entered their credit card information into Facebook, whether that’s for Credits or an in-game purchase.

When these customers get to the checkout stage, they’re presented with a ‘Check out faster with Facebook’ button. Click on it, and they’re instantly taken to the Facebook app on their phone, where they can verify their payment details and choose an address for posting.

Once that’s done, they are taken back to the original app, while Facebook and the other app transfer the details securely.

There are some obvious advantages to this both for the consumer and the retailer. It makes checkout a lot easier and faster. You don’t have to get out your credit or debit card and type it into your phone.

And remember a few years ago, when your Facebook feed was cluttered up with requests from people playing Farmville, who wanted your help to buy a pixelated cow? Well, a large proportion of those people will have put their credit card details into Facebook in order to make in-game purchases. So there’s an audience ready and waiting.

The future of mobile payments?

These two new developments illustrate that the prize of easy, accessible and widespread mobile payments is still there for the taking, despite the huge variety of companies and technologies in the space. If either Apple or Facebook could crack this, it will add fuel to the mcommerce fire. That will hasten the trend for consumers to shop using their phones, making it easier to mobile marketers to drive sales.

It makes sense that it would be a huge tech company that solves this problem. They already have the reach, which has been a problem for other mobile payment providers, and they also have the budget to push things forward. We’ll be watching closely to see which system wins out.