App Commerce by Poq – August Round-Up 2020

As many of us adjust to the ‘new normal’, retailers are looking ahead to holiday and Black Friday 2020. August saw news that the UK has officially gone into recession as the pandemic triggered the economy to shrink by 20.4% between April and June. This month we examine the latest research about consumer behaviour during the recession and predictions for the holiday period.

How COVID has Changed the Way we Shop

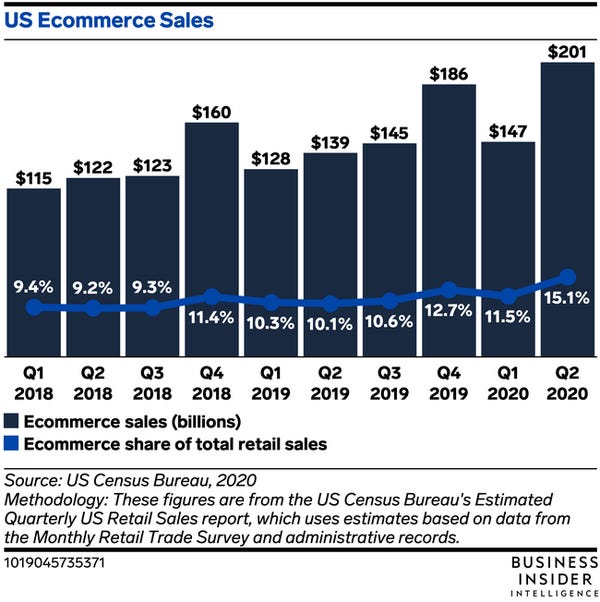

Despite the economy going into a recession in the UK, sales on mobile grew 30% compared to Q1 2020 and 25% greater than Q4 2019 – this level of growth was originally predicted to take 3 to 4 years. The time consumers spent on mobile grew too, on average shoppers were spending 27% of daily waking hours on mobile, that’s approximately 4.3 hours a day. Meanwhile, in the US, despite retail sales falling 3.4% year-on-year (y-o-y), ecommerce sales actually grew 44.4% y-o-y in Q2, seeing ecommerce’s share of retail sales growing to 15.1%.

According to McKinsey, three-quarters of consumers tried a new shopping behaviour since COVID, with almost 60% saying that convenience drove these new behaviours, and nearly 20% said they shopped with a new retailer in the past 3 months because of safer or more convenient shopping options like delivery or Click-and-Collect options. Forrester points out that app upgrades have been of particular importance to retailers’ omnichannel strategies, using the technology to help consumers in-store. For example, Home Depot’s app hosts a wayfinding feature that helps shoppers quickly search and find a product’s exact location in-store, and reduce their contact with people and the time spent in-store.

Looking ahead, the pandemic is suggested to have permanently changed shopping habits, with online sales expected to account for over 25% of retail sales over the next 5 years, meanwhile footfall is predicted to shrink 20%. Not only are consumers choosing to interact with retailers through digital channels since the start of the pandemic – something that will persist in the future – but Forrester suggests shoppers have become more focussed on value-driven shopping – choosing a retailer by aligning with a business’ political, social, environmental and ethical values.

Hear live from the likes of Cotton Traders & Hotter Shoes about how the baby boomer generation has adopted digital and their shopping habits have changed for good at the panel session: “Generation Zoom: How COVID has Changed Attitudes and Relationships with Digital Technology“

The preference for digital has been driven by mobile app experiences and utilised by retailers to stand out from their competitors. As many as 34% of shoppers have placed an order via app in the UK during the pandemic according to new research and 28% of US shoppers used an app to make a purchase. Not only do apps make the online shopping experience more efficient and convenient but apps provide the opportunity for retailers to ensure social distancing in-store and help to differentiate brands and retailers from their competitors.

However, British value fashion retailer, Primark – that exclusively sells in stores – is attempting to engage shoppers digitally by launching a mobile app game called “Primark Legends”. This “fast-paced, shop assistant simulator” tasks players to run a shop floor and aim to create conga lines of happy customers. Primark isn’t the first brand to dabble in gaming to engage with customers either. From fast fashion to luxury brands, retailers have seen gaming an invaluable method to engage customers. We anticipate brands will continue to find innovative ways to engage with shoppers digitally over the foreseeable future.

Recommended read and useful statistics:

O2’s “The Big Ask Report” based on survey data from July 2020 provides some compelling insights into consumer behaviour. Here are some of the important stats from the report:

- “81% of all consumers spend more time browsing for retail products online than in-store”

- “45% of customers have now purchased a product online that they had only ever purchased in-store prior to the pandemic”

- ”44% of customers agree that it is likely to lead to long-term changes in their shopping habits”

- “49% of consumers now spend more time researching products online”

- “In 2017, commuters were estimated to have spent £2.6bn”

Black Friday Predictions

As we’re in an unprecedented time, making predictions for Black Friday is tricky. However, there seems to be a general consensus that shoppers will be more cautious about their spending this Black Friday than in previous years. This cautious spending mindset is also likely to be reflected in back-to-school shopping in the USA.

Footfall in stores this Black Friday is likely to be lower than previous years too. A survey of UK consumers found that 35% of shoppers will be looking for deals exclusively online this year. Meanwhile, Emarsys predicts that 58% of shoppers plan to buy solely online this Black Friday. And as digital sales grew 14% on Black Friday 2019, Contensquare predicts that sales will likely grow even more this year. However, those that 27% of consumers will start shopping for Christmas earlier than last year according to eBay.

With the added pressure on making sales this Black Friday, retailers need to ensure their digital channels are optimised. According to new research from Retail Systems, 52% of shoppers feel frustrated when shopping on a slow website, and 90% of shoppers leave a website if it is loading slowly. The research also identified that 32% make purchases on their mobiles because it’s easy.

Hear more on how to prepare your business for Black Friday with “Top Tips for Holiday Trading in Uncertain Times” by Poq’s Senior Marketing Manager, Elliott Barton at the AppCommerce Virtual Festival.